Managing finances becomes easier when you understand how structured lending options can support your plans. Affordable loans programs are designed to provide access to necessary funds without adding pressure to your financial routine. Whether you want to improve your savings discipline, manage existing obligations, or prepare for future expenses, these programs offer flexibility that suits different financial situations.

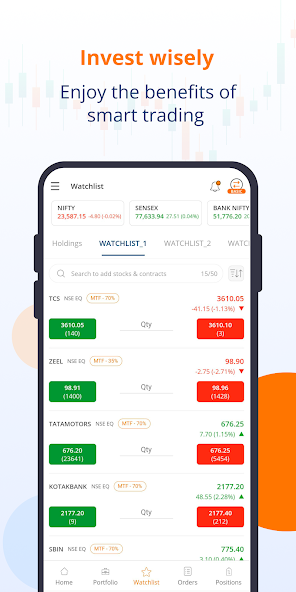

Using a personal finance app can help you track your spending, predict repayment needs, and plan ahead for financial responsibilities. Alongside that, a loan repayment app can simplify repayment schedules, give you reminders, and reduce the risk of missing deadlines. When both tools complement a well-chosen loan program, they create a strong foundation for steady progress.

This article explains how affordable loans programs work, what makes them helpful, who can benefit from them, and how to plan your repayment strategy responsibly.

Understanding the Structure of Affordable Loans Programs

Affordable loans programs aim to help individuals access money at manageable terms. These programs usually focus on providing flexible tenure and reduced interest obligations while keeping transparency in the borrowing process. Instead of pushing strict repayment rules, they prioritize long-term financial health and manageable commitments.

Key Elements of These Programs

- Simplified Eligibility Criteria:

Most programs have relaxed requirements to make borrowing accessible to more individuals. Income stability, basic identity documents, and a clear repayment plan are usually enough. - Flexible Repayment Tenure:

These programs typically allow borrowers to choose repayment timelines that align with their financial capacity. Shorter periods reduce interest costs while longer schedules offer comfortable monthly payments. - Clear and Predictable Terms:

Borrowers can review interest rates, processing requirements, and repayment structure before committing. This helps reduce surprises during the loan tenure.

Why Affordable Loans Programs Matter for Financial Stability

Many people avoid borrowing due to concerns about high interest costs or complicated documentation. Affordable loans programs solve this by focusing on stability and accessibility.

Support for Unexpected Expenses

Life often brings unplanned costs such as home repairs, medical needs, or educational requirements. Affordable programs allow individuals to respond to such situations without delaying essential expenses or draining their savings.

Opportunities for Personal Development

These programs can support learning, skill development, or career-related investments. Instead of postponing growth due to lack of funds, borrowers can take timely steps toward their goals.

Enhanced Budget Control

When used responsibly, a well-structured loan reduces financial strain. You can distribute expenses over time, making it easier to manage monthly budgets. A personal finance app is particularly helpful here as it gives a clear view of income, spending, and upcoming dues.

Eligibility and Application Process Explained

Although requirements differ across providers, most affordable loans programs follow a straightforward approach.

Basic Eligibility Factors

- Age Requirements:

Applicants must fall within the typical adult age bracket defined by lending regulations. - Income Source:

A stable income—whether from employment, freelancing, or business—helps ensure repayment capacity. - Financial Behaviour:

Applicants with a responsible handling of past obligations are often favored.

Application Steps

- Verification of Documents:

Identification, income records, and address proof are usually required. - Assessment of Borrowing Needs:

Borrowers should define why the funds are required and how they plan to use them. - Selection of Repayment Plan:

Choosing a schedule that aligns with monthly budgeting habits makes repayment stress-free. A loan repayment app can support this by mapping each due date.

Comparing Different Loan Options

Understanding the variations among loan types helps borrowers select the correct fit.

Short-Term Loans

These are suitable for immediate expenses that require quick access to funds. They carry a shorter tenure and may work best for controlled, time-sensitive needs.

Medium-Term Loans

These provide a balance between timely cost coverage and manageable monthly payments. They work well for moderate expenses like home improvements or skill-building courses.

Long-Term Loans

Used for larger commitments, such as major renovations or long-term financial plans, these loans stretch over several years. They lower the monthly payment burden but increase the duration of repayment.

Building a Responsible Repayment Strategy

The effectiveness of any loan depends on how well the borrower manages repayment.

Tracking Expenses and Setting Limits

Monitoring day-to-day spending with a personal finance app ensures that repayment does not conflict with essential expenses. Regular tracking reveals where adjustments can be made to maintain a consistent repayment routine.

Scheduling and Automation

A loan repayment app helps you stay organized by sending reminders or enabling auto-debit setups. It decreases the chance of overdue payments and ensures that the repayment plan stays on track.

Gradual Prepayment Approach

When financial conditions improve, borrowers may choose to pay off smaller portions earlier. This approach reduces interest load over time and shortens the loan cycle.

Common Mistakes Borrowers Should Avoid

Even with affordable programs, responsible borrowing remains essential.

Borrowing More Than Necessary

Loans should only be taken for actual needs. Overborrowing increases monthly obligations and long-term financial pressure.

Ignoring Monthly Obligations

Skipping payments or delaying dues can lead to long-term consequences. Proper planning with digital tools minimizes this risk.

Not Comparing Multiple Options

Evaluating different plans ensures you select a structure that fits your income patterns and repayment habits.

Conclusion

Affordable loans programs offer a structured path to take control of financial plans without placing unnecessary strain on your monthly budget. By pairing these programs with tools like a personal finance app and a loan repayment app, borrowers can gain clarity, monitor progress, and stay in charge of their financial journey. With clear terms, flexible repayment choices, and responsible planning, these programs act as a foundation for achieving long-term financial stability and supporting personal development.

Let this understanding guide you toward informed borrowing decisions and a confident approach to managing future financial goals.