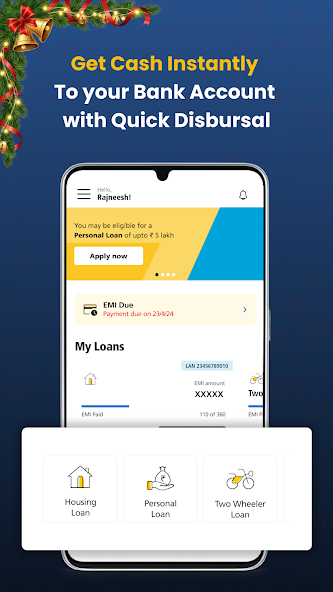

In today’s fast-moving financial environment, the need for quick and reliable funding has become common for individuals and families alike. Whether it is managing household expenses, handling medical needs, or planning long-term assets, digital borrowing has become a preferred option. Online Loan apply methods now provide a structured way to access funds without complex paperwork or repeated visits. From short-term requirements to structured financing like a Home Loan, online platforms offer flexible solutions for different financial goals.

The convenience of Online Loan applications has transformed the borrowing process by reducing delays and increasing transparency. With simple eligibility checks and clear repayment structures, borrowers can make informed financial decisions. This explores how online loan options work, who can apply, and how to use them responsibly for instant financial support.

Understanding Online Loan Apply Options

What Does Online Loan Apply Mean?

Online Loan apply refers to the digital process of submitting loan requests through online platforms. Instead of visiting physical offices, borrowers can complete the application from their devices. The process generally includes basic personal details, income information, and purpose of borrowing.

This approach benefits individuals who prefer time-efficient solutions and structured documentation. It also helps borrowers compare loan structures, interest ranges, and repayment terms before proceeding.

Types of Loans Available Online

Online loan platforms usually support multiple borrowing needs. Some common categories include:

- Short-term personal borrowing for urgent expenses

- Long-term financing for structured goals

- Education-related funding

- Property-related borrowing such as a Home Loan

Each option follows different eligibility rules, repayment durations, and documentation requirements. Choosing the correct category is important for maintaining financial balance.

Benefits of Choosing Online Loan Apply Methods

Easy Accessibility

One of the major benefits of Online Loan apply options is accessibility. Borrowers can submit applications at any time without geographical limitations. This makes it easier for working individuals and remote users to seek financial support.

Transparent Process

Digital loan applications provide clear information on repayment schedules, charges, and timelines. This transparency allows borrowers to plan monthly budgets more efficiently, especially when managing large commitments like a Home Loan.

Faster Processing

Online systems reduce manual verification time, resulting in quicker approvals compared to traditional methods. For urgent financial needs, this speed becomes a key advantage.

Eligibility Criteria for Online Loan Applications

Common Eligibility Requirements

While eligibility varies depending on loan type, most Online Loan apply processes require:

- Minimum age requirement

- Stable income source

- Valid identification documents

- Bank account details

For structured borrowing such as a Home Loan, additional criteria like employment history and income consistency may apply.

Credit Assessment

Credit evaluation plays a role in determining loan approval and interest structure. Maintaining a disciplined repayment history improves eligibility for better loan terms over time.

Documentation Required for Online Loan Apply

Basic Documents

Most online loan applications request standard documents, including:

- Identity proof

- Address proof

- Income statements

- Bank account records

These documents help verify the applicant’s financial standing and repayment capacity.

Additional Documents for Home Loan

For property-related borrowing, documentation may include property details, ownership records, and income stability proof. Submitting accurate documents ensures smooth processing.

Step-by-Step Online Loan Apply Process

Step 1: Choose the Loan Type

Applicants should clearly identify whether the requirement is short-term or long-term. For example, selecting a Home Loan differs significantly from choosing a personal borrowing option.

Step 2: Fill in Application Details

The Online Loan apply form usually includes personal, financial, and employment information. Providing accurate details reduces verification delays.

Step 3: Upload Documents

Applicants upload required documents digitally. Ensuring clarity and completeness helps avoid rejection or follow-up requests.

Step 4: Review and Submit

Before submission, reviewing the entered details and loan terms is essential. This step prevents errors and supports informed decision-making.

Smart Financial Planning with Online Loans

Borrow Only What Is Needed

Responsible borrowing starts with understanding the actual requirement. Applying for an Online Loan that matches the financial need helps avoid repayment stress.

Understand Repayment Terms

Loan repayment schedules vary based on tenure and loan type. For long-term commitments like a Home Loan, planning monthly obligations in advance is important for financial stability.

Maintain Financial Discipline

Timely repayments strengthen credit health and improve eligibility for future borrowing. Digital platforms often provide repayment tracking tools to support discipline.

Common Mistakes to Avoid During Online Loan Apply

Incomplete Information

Submitting incomplete or inaccurate information may delay approval. Always double-check entries before submission.

Ignoring Terms and Conditions

Understanding loan conditions is essential to avoid unexpected charges. Reading all terms carefully ensures clarity throughout the loan period.

Overlooking Long-Term Impact

Borrowers should evaluate how monthly repayments affect savings and daily expenses, especially when committing to long-term loans like a Home Loan.

Role of Online Loans in Long-Term Financial Goals

Online borrowing is not limited to short-term needs. Structured options allow individuals to plan major life goals, including property ownership and education funding. A well-planned Online Loan apply strategy can support financial growth while maintaining stability.

Using digital tools to manage applications, track repayments, and monitor financial health adds convenience and control for borrowers.

Conclusion

Online Loan apply options have reshaped how individuals access financial support by offering speed, clarity, and flexibility. From immediate cash needs to structured financing like a Home Loan, digital borrowing provides practical solutions when used responsibly. Understanding eligibility, documentation, and repayment terms helps borrowers make informed decisions and maintain financial balance.

By choosing the right Online Loan based on genuine needs and planning repayments carefully, individuals can use online borrowing as a supportive financial tool rather than a burden. As financial needs evolve, digital loan platforms continue to offer accessible pathways for secure and timely funding.